A Quick Guide to Acquiring Your Commercial Truck in NJ

For businesses in New Jersey, commercial trucks are the lifeblood of operations, from ensuring timely deliveries to supporting vital construction projects. Acquiring these essential assets, however, requires careful consideration, particularly when it comes to financing. The method you choose to fund your commercial truck can significantly impact your business’s financial health and operational flexibility.

This guide will generally explore various avenues for obtaining commercial trucks in NJ, from diverse leasing structures to traditional financing methods, and touch upon how these choices can typically affect your business’s financial statements. It’s crucial to remember that financial implications can vary, and consulting with your accountant is always recommended for personalized financial advice.

Understanding Your Commercial Truck Financing Options in NJ

When considering how to acquire a commercial truck, New Jersey businesses have a range of financing options available. Understanding the nuances of each is key to making a decision that aligns with your operational needs and financial strategy.

Closed-End or “Walk Away Lease” Lease

Generally, this type of lease offers lower monthly payments as you’re essentially renting the truck for a specific term. (It often has a mileage limitation or penalties for going over the mileage limit.) At the end of the lease, you typically return the vehicle to the dealership (with no further obligations). This may have off-balance sheet implications, but consult your accountant for specifics.

Terminal Rental Adjustment Clause (TRAC) Lease

This lease structure is somewhat akin to financing but often includes a predetermined residual value for the truck at the end of the lease term. You generally have the option to purchase the truck for this amount, (refinance the residual (or have it sold at fair market value). The financial treatment can vary, so speak with your accountant about potential on or off-balance sheet impacts. (Ultimately the lessee is responsible for the residual value)

Dollar Buyout Lease or $1 Buyout Lease

This is a variation of the Trac Lease where the predetermined purchase option at the end of the term is a nominal amount, often just one dollar. While technically a lease, it often functions similarly to a purchase agreement with potential on-balance sheet implications.

Capital Lease or Finance Lease

This type of lease is treated more like a purchase for accounting purposes. It typically transfers ownership risks and rewards to the lessee. Generally, capital leases are recorded on your balance sheet as an asset and a liability.

Traditional Financing

This is a traditional loan where you borrow funds to purchase the truck outright. You own the asset from the start and it will be recorded on your balance sheet.

Financing with Balloon Payments

This involves a loan with lower payments during the term and a large lump-sum payment (the balloon payment) due at the end. While you own the truck, the structure of the loan can have specific balance sheet implications. Seek advice from your accountant regarding the financial reporting.

Generals Steps for The Acquisition Process

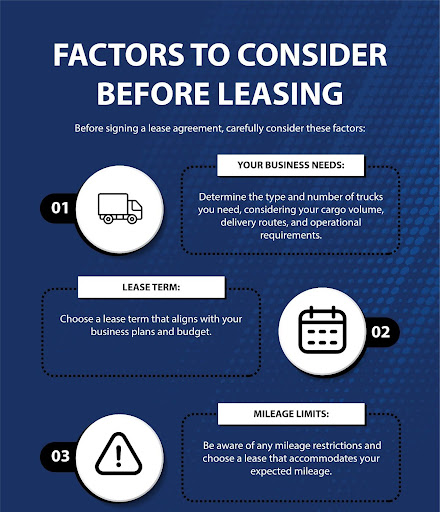

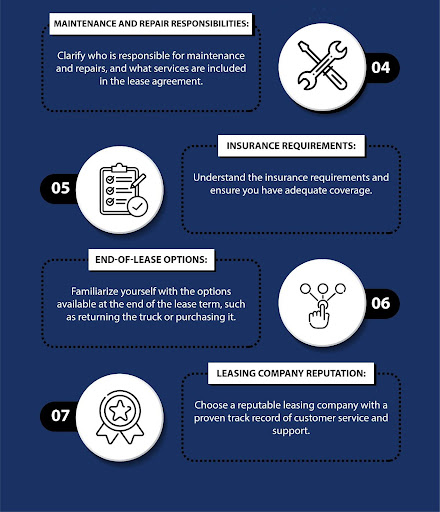

The leasing process typically involves these steps:

- Assess Your Needs: Determine your truck requirements and budget. Here at HK Truck, we offer free fleet analysis to help you assess if leasing is right for you.

- Research Financing Options: Compare terms and conditions from various providers.

- Apply for Financing: Submit an application and provide necessary documentation.

- Review the Agreement: Carefully review all terms and conditions before signing.

- Acquire Your Truck: Once approved, you’ll take possession of your commercial vehicle.

NJ-Specific Considerations

While New Jersey’s specific regulations and business environment might influence the type of truck you need, the fundamental financing options remain the same.

Emission Standards: Be aware of NJ’s emission standards and choose trucks that comply with regulations.

Toll Roads: Factor in toll road costs when calculating your operating expenses.

Traffic Congestion: Consider traffic congestion in your delivery routes and choose trucks that are suitable for urban environments.

Advanced Clean Trucks (ACT) regulation: While this regulation primarily affects manufacturers, it will impact truck availability and pricing. When considering lease options, factor in the potential shift towards ZEVs and discuss future-proofing your fleet with your leasing partner.

HK Truck Center for Your Commercial Truck Needs

Choosing the right way to finance your commercial truck in New Jersey is a critical decision. At H.K. Truck Center, we understand that every business has unique needs and financial considerations. We are here to help you explore the various financing options available and connect you with reputable providers. Remember, while we can offer general information about leasing and financing, it is essential to consult with your accountant to understand the specific impact of each option on your business’s financial statements.

Reach out to us today to discuss your commercial truck needs and explore the possibilities. We’re committed to helping you find a solution that supports your business objectives.